In fact, many parties have realized how important and profitable to invest in the healthcare sector earlier, I am talking here about countries and healthcare authorities in the Middle East that have already started to take some serious steps to develop their Healthcare system, such as adopting new management methodology like total quality management TQM, revenue cycle management RCM, etc.

United Arab Emirates was the first mover, it spent billions of dollars and huge investments in medical education, and medical training for personnel and equipping healthcare facilities with the latest technologies, and today it has already come a long way.

Here we would come to some common questions!

How many patients pay for their healthcare services in cash? And who is not covered by at least one health insurance nowadays?

We live in the health insurance coverage era, many health insurance companies start their business in the Egyptian market every year, approaching multiple marketing strategies and providing many health insurance package’s ” Individual package, family packages, firms’ packages, etc.”.

This is in addition to the Egyptian governmental health insurance parties which is living great develop recently from the government, represented in Comprehensive Health Insurance Law issuance in 2018, specialized authority in accreditation, monitoring and regulating the quality of medical services provision ” General Authority for Healthcare Accreditation and Regulation (GAHAR), that’s why claims become the most generally accepted payment method between providers and insurance companies.

“If you are bringing in a certain amount of revenue, you can’t have expenses that exceed that revenue. It seems very basic, but people don’t look at it that way.”

GARY MARLOW, VICE PRESIDENT OF FINANCE FOR BEVERLY HOSPITAL

So, What is the Insurance Claim?

The insurance claim is a formal request from the hospital to the insurance company that asks for a payment of services given to a patient based on a former contract between the hospital and the insurance company.

The insurance company would review the claim of the hospital to validate its items then it pays out the requested amount of money to the hospital after approval.

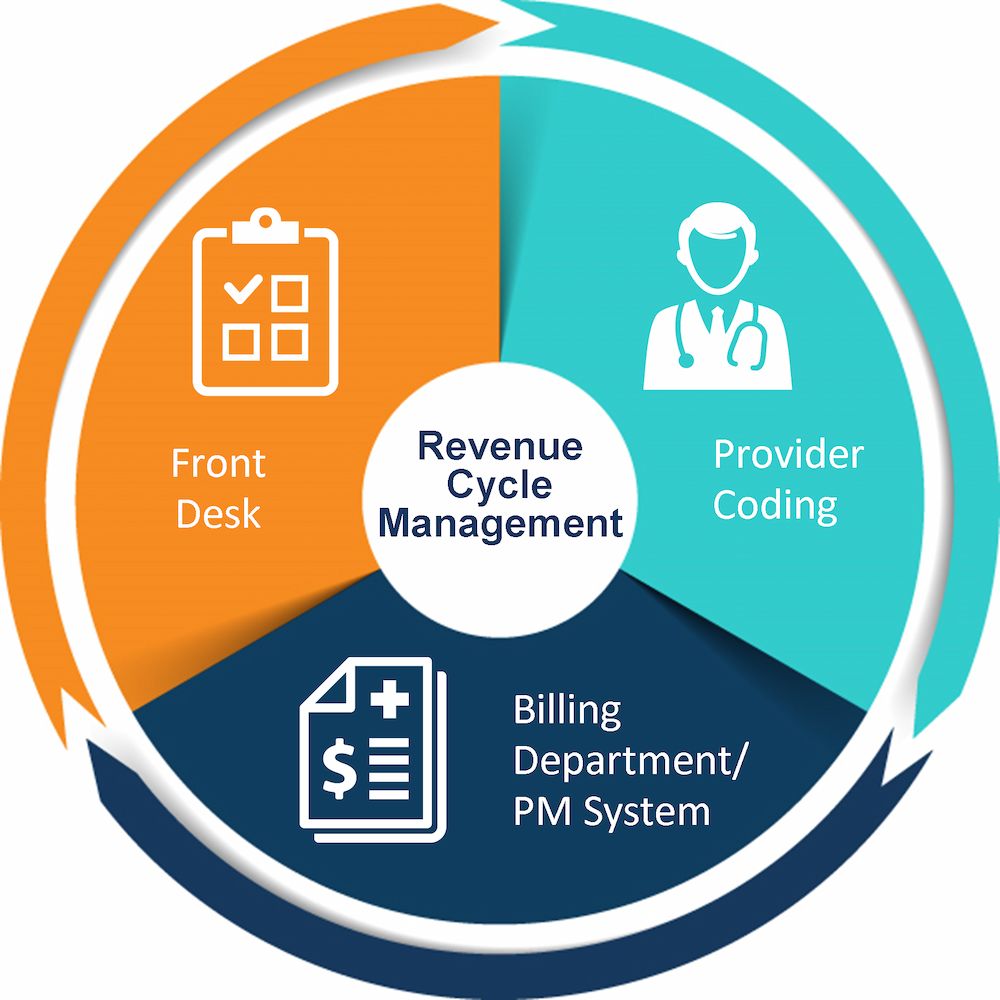

What is the Revenue Cycle Management (RCM) for Healthcare facilities?

Healthcare revenue cycle management is a financial process, hospitals use it to manage their operational, financial even administrative issues associated with claims processing, payment, and revenue generation, which contains identification, management, and collection of healthcare service revenues.

On the other hand, medical coding as an example is one of the main pillars of revenue cycle management (RCM) systems, it is the process of translation to all medical documentation, patient records, medical history, etc. to a widely acceptable and recognized code, and we will talk about medical coding in some deep details in the upcoming articles.

In this article, we will discuss the basics of healthcare revenue cycle management (RCM) and how it impacts the healthcare industry.

Healthcare revenue cycle management (RCM) begins when a patient schedules his appointment for a medical service and ends when all claims and patient payments have been collected. However, the patient’s lifecycle is not as straightforward as it looks like.

Registration and Booking Appointment for Patient

As we mentioned, the first step in the RCM system is registering patient data in the practice management system and booking an appointment either through the call centers, online, or individually.

Administration staff must handle the following processes:

- Patient appointment scheduling.

- Insurance eligibility verification.

- Patient account establishment.

Collection of any Due Co-Payments from the Patient

After that, the healthcare facility should calculate any amount of money to be collected from the patient, this amount is variable and may differ from a patient to another according to the insurance contract between the insurance company and the healthcare facility.

Co-Payments could be as a percentage of the service price, or a specified value written in a published Co-Payments list for each insurance company.

Patient Visit Documentation

Then, patient visits his physician’s office for a medical investigation, that must be scientifically and fully documented, as it is as important as the medical advice itself, because it is going to be archived in patient medical records which has an impact on the quality of patient care.

Medical Coding

One of the most important stages in RCM system, when the “Medical coder” translate all patient’s medical documents such as diagnoses, procedures, medical tests etc. into some organized and acceptable codes which designed according to certain policies and rules.

Costing and Pricing

Generally, you cannot provide any healthcare service to a patient without accurate calculation of your costs, profit margin, selling prices. even if you are not seeking a profit like charity hospitals. simply, it is your guarantee to continuity.

So, you have to calculate all your costs then determine which pricing strategy you should take? and why? – if you want to know more about the importance of pricing and different pricing strategies kindly review our articles “Healthcare Services Pricing in the Egyptian Healthcare System – 6 Powerful Pricing Strategies Used in Healthcare”

Now, after the Medical coder finished his job, you should record all services prices that your patient has. here we can tell that our claim is established and ready to send to the insurance company after the medical and financial revision.

Claim Submission

At this level, your claim is ready to send to the party that will pay, whether it is a private or governmental insurance company or any other party.

Accounts Receivable Management

Finally, the financial accounts receivable team’s role comes in following up the hospital’s dues with insurance companies, receiving financial dues, submitting financial reports, and following up on rejected claims.

And now after we had a quick review on hospital RCM systems, we have to say that it not always this simple, you must know that insurance companies will examine the claim, medical procedures, prices and in many times will deny the claim and return it to the hospital.

Hospital claims denial rate has increased since 2016, But the recent COVID-19 pandemic has accelerated that upward trajectory, pushing the denial rate up to 23 % in 2020 compared to the last 4 years, according to Revcycle Intelligence.

Best practices have taught us that most of these claim denials are potentially avoidable, but hospitals must develop some Strategies to minimize claims denials such as staff training, RCM system automation, do some analysis for the most common reasons for claim denials.

Overall, report says that 86% of claims denials were potentially avoidable by hospital staff, artificial intelligence also can make a huge difference to healthcare organizations and RCM systems

Those manual processes like patient access, coding, billing, collections, and denials can be easier if it has been automated using artificial intelligence (AI).

The Conclusion

Finally, we have to say that revenue cycle management in healthcare is not just some sections or employees, it’s much bigger, it’s a whole system that affects your patient satisfaction, in cash flows, accounts receivable, financial statements, and shareholders.

So, if you manage this system efficiently, handle its errors, you will guarantee that your business will continue to grow safely.

If you liked this article, please don’t forget to share your thoughts and best with HBC in the comments and let us know your opinion about the revenue cycle management (RCM) for healthcare facilities and its importance for organization’s growth. If you have valuable content to share on Healthcare Business Club you can publish your content for free and share your knowledge with all healthcare business professionals, send your articles to the HBC editorial team on [email protected] please don’t hesitate to contact us at any time.